Articles

Lorem ipsum dolor sit amet, consectetur adipisicing elit.

Recent Articles

FUNDAMENTAL ANALYSIS OF CRYPTOCURRENCIES

FUNDAMENTAL ANALYSIS OF CRYPTOCURRENCIES

As a crypto trader, you must know what causes prices to rise, fall, or idle.

While markets are not always predictable, with sound analysis, you can often get at least a reasonably good idea of what the most probable scenarios may be.

A good trader knows when to trade. They recognize market trends and identify areas where they can reliably predict what is going to happen next.

But how do they do it?

There are two answers here: fundamental analysis and technical analysis.

Technical analysis is a tool, or method, used to predict the probable future price movement of a currency pair based on previous market data.

Fundamental analysis looks at the fundamentals of an asset, or in other words, every aspect of an asset that contributes to its overall value.

In this blog, we will focus on fundamental analysis.

The Basics Of Fundamental Analysis

Fundamental Analysis is not only for cryptocurrencies it’s ingrained in other types of trading too. Fundamental analysis is researching your investments to determine their future value.

If you can recognize the future potential of a project, or realize that the project is presently undervalued in the market, you can buy that coin and earn profit. Keep an eye on their social media platforms if they announced some news then you can easily make money.

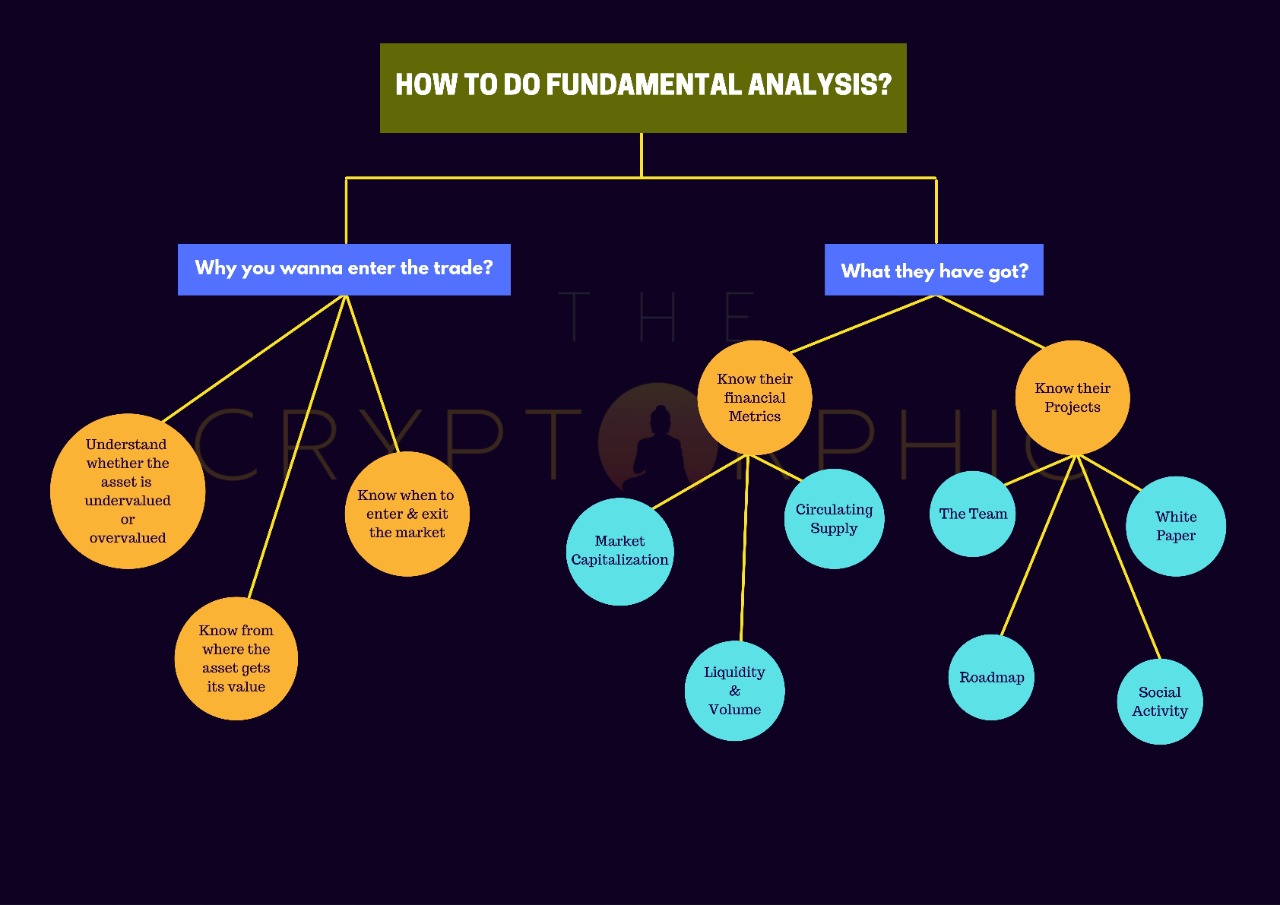

HOW TO DO FUNDAMENTAL ANALYSIS?

There are several factors to look out for when we analyze any coin:

- Team

- Roadmap

- Development and releases

- Whitepaper

- Partnerships

- Community and reviews

- Liquidity and volume

- Real-world use case

- Social Activity

- Price history

- Market cap

Team

Successful products have great teams behind them.

What can you find out about the team?

Look at the senior management: who are they, where they are from, what’s their history? If there is a skilled team with a wealth of experience, that’s definitely a good sign.

Roadmap

Crypto projects often have roadmaps in one form or another. They show what upcoming plans there are to move the project forward. Take a look at these plans and see what you think.

Development and releases

Just like a roadmap looks into the future, you can look back and see how a project has performed over time in terms of development.

If there is a healthy history of releases, that’s a good look.

Whitepaper

Whitepapers outline the essential details of a project. They are technical documents, but they are important. They will detail everything you need to know about how it works, which can massively influence your investment decisions.

Read whitepapers before investing.

Partnerships

In crypto, partnerships are important for assigning value, but make sure you understand the details of the partnership before passing judgment.

Community and reviews

Take a dive into the community and read reviews about the project. See what different people have to say about it.

Liquidity and volume

Liquidity is the ability of a coin to be easily converted into cash or other coins.

Liquidity is important for all tradable assets including cryptocurrencies. Low liquidity levels mean that market volatility is present, causing spikes in cryptocurrency prices. High liquidity, on the other hand, means there is a stable market, with few fluctuations in price.

Real-world use case

This is important. While a project may have great fundamentals, ask yourself whether it has to use blockchain and have its own cryptocurrency. If it doesn’t, that is something to think about. It could sway long-term value, one way or another.

Social Activity

It is the easiest way to earn money in crypto. You just have to keep a close eye on social media platforms like Twitter, Telegram, Reddit, etc. you can easily check any cryptocurrency social activity by just searching the name of that currency on our website.

Price history

Cryptocurrencies come and go. If a project has been established for a long time and has consistently maintained value relative to other cryptos, perhaps it has longevity.

However, larger returns may be found from smaller, relatively unknown coins that breakout and become mainstream.

Market cap

A market cap takes into account the supply of crypto and derives the actual value based on that.

Take into account the market cap to see the potential for growth. Projects with larger market caps most likely have smaller growth potential relative to lower cap ones.

Summary:

Whenever you are looking for an investment keep these things in mind. It is a great way for you to get started analyzing potential coins to help you become a better trader.