Articles

Lorem ipsum dolor sit amet, consectetur adipisicing elit.

Recent Articles

How to Spot a Bull Market vs. Bear Market in Crypto

The cryptocurrency market is notoriously volatile, swinging between bullish uptrends and bearish downturns with little notice. Understanding how to identify whether you're in a bull or bear market is crucial for traders looking to optimize their strategies. Here's a guide to help you spot the key differences and adjust your trading approach accordingly.

What Is a Bull Market?

A bull market refers to a period where prices are rising or are expected to rise. In crypto, this often comes with a general sense of optimism, higher trading volumes, and an influx of new investors. During a bull market, sentiment is generally positive, and prices of most cryptocurrencies rise significantly.

Key Indicators of a Bull Market:

- Price Uptrend: A sustained increase in the prices of cryptocurrencies over time. Look for higher highs and higher lows in chart patterns.

- High Trading Volume: Increased buying pressure often accompanies bull markets. Look for volume spikes that indicate strong interest in crypto assets.

- Positive Sentiment: Social media, news outlets, and influencers often talk favorably about crypto, driving more hype and investment.

- Increased Demand for Risk: Investors typically move toward higher-risk assets like altcoins, ICOs, or meme coins during a bull run.

Trading Strategies for a Bull Market:

- Buy the Dip: Buying cryptocurrencies during brief pullbacks can allow you to capitalize on the overall upward trend.

- HODL: Holding onto positions long-term can yield significant gains as the bull market progresses.

- Leverage: Advanced traders might use leverage to amplify their returns, but be cautious of risks.

- Take Profit Gradually: Lock in gains at various stages of the bull market to protect yourself from sudden downturns.

What Is a Bear Market?

A bear market occurs when the market experiences prolonged declines in asset prices, typically falling 20% or more from recent highs. In a bear market, fear, uncertainty, and doubt (FUD) dominate the sentiment, and investors are more likely to sell off assets to avoid further losses.

Key Indicators of a Bear Market:

- Price Downtrend: Continuous lower highs and lower lows in cryptocurrency prices signal a bear market. The trend is generally downward.

- Low Trading Volume: As confidence wanes, trading activity slows, and fewer buyers are willing to enter the market.

- Negative Sentiment: Media coverage tends to focus on market crashes, regulation fears, and exit scams, further driving panic.

- Flight to Safety: Investors move out of risky assets and into safer options like stablecoins, fiat, or even cash.

Trading Strategies for a Bear Market:

- Shorting: Experienced traders may profit by shorting cryptocurrencies, betting that prices will continue to fall.

- Stablecoins: Convert volatile assets into stablecoins (like USDT, USDC) to preserve your capital and avoid price declines.

- Dollar-Cost Averaging (DCA): Gradually buying into positions during downtrends can reduce the average entry price over time.

- Diversify: Holding a variety of assets, including non-correlated ones like precious metals, can help hedge against bear market losses.

Key Differences Between Bull and Bear Markets

| Bull Market | Bear Market |

|---|---|

| Rising prices | Falling prices |

| High trading volume | Low trading volume |

| Positive sentiment | Negative sentiment |

| Investors take on more risk | Investors seek safety |

How to Adjust Your Trading Strategy

- In a Bull Market: Focus on identifying strong cryptocurrencies early, use dips as buying opportunities, and be mindful of taking profits incrementally to secure gains.

- In a Bear Market: Protect your capital by shifting into stablecoins or safer assets, consider shorting, and employ dollar-cost averaging to build positions for the long term.

By recognizing whether the market is bullish or bearish, you can better position your portfolio for both short-term gains and long-term success. Adjusting your strategy to the prevailing market conditions is key to navigating crypto's notorious volatility.

Conclusion: Spotting a bull or bear market in crypto requires a keen eye for trends, volume changes, and market sentiment. By understanding these patterns and adapting your trading strategy accordingly, you’ll be better equipped to manage risk and maximize gains, regardless of market conditions.

The Ultimate Altseason Cheat Sheet 2024! Timing Your Entry into Alts

Hello everyone, welcome to the article!

I'm Cryptorphic, and since 2018, I've been accurately predicting BTC Bottoms and Altseasons. I'm eager to see if we can do it again this time! Those who've been with me for a while know this isn't about boasting, but rather about getting your attention on the right track.

By the time you finish reading this article, you'll have a good idea of how and when you can enter Altcoins!

If you want to see my track record, check out my past dominance charts from 2018 onwards!

Altcoins are currently trading 50% to 70% down from their recent highs in February and March. Is it the right time to enter altcoins, or should we wait? All your questions will be answered here!

BTC dominance is currently facing rejection on the weekly chart around the 57% resistance, now trading at around 54.20%. Even though this rejection is visible in the chart, altcoins aren't moving much. Historically, May has been bearish, so the next few weeks will be important for altcoins.

When to Enter Altcoins:

This is probably the right time to start scaling in with small fractions. You won't be able to enter every altcoin you like exactly at the bottom, so we DCA! I've already made a list of 15 altcoin gems which I will post soon, so follow me if you don't already! And make sure we are connected on other platforms too.

Best Time to Enter Altcoins

Technically, May is Bearish for the whole crypto market. And it brings opportunities!

If BTC dominance somehow pumps and touches the 60% level, we will see the final dip in altcoins. This will provide us with the best entry possible in altcoins, where we will enter hard. I am patiently waiting for that to happen.

I am expecting this to happen in the next 2 to 4 weeks.

This means May and the beginning of June will be the time to accumulate Altcoins!

Keep in mind that most of the time traders make money is when most of the people aren't really interested in the asset, which applies to altcoins in the current scenario.

Conclusion:-

Dominance is expected to touch a high point of 60%+, signalling potential opportunities in many altcoins. Our goal is to accumulate the best altcoins that haven't seen significant pumps yet, backed by reputable VCs, and featuring solid tokenomics and on-chain metrics. It's also essential to evaluate multiple factors like the team, token unlocks, inflationary and deflationary aspects, and more.

If you're unsure about how to navigate this, just follow me for future updates!

Always do your own research, This is not Financial Advice!

If this post brought you value, please hit the like button. Your likes and comments keep me and my team motivated.

Thank you.

#BITCOIN Roadmap to $93k! Know the Plan!

Hello everyone, first off, stay strong—things are going to improve soon!

Many people are confused right now and might get liquidated, eventually leaving the market and regretting it later. But not you! You have access to this information.

Take your time to read and understand the current situation fully.

Special Thanks to my close friend Adison for the valuable insights he shares with the community and me!

Please HIT that follow to stay ahead and like this article if it helps!

Key Bottom Ranges to Watch For:-

There are two high-confluence zones to look out for that could signal a strong bounce and an upward move:

• 50,521 - 50,901

• 46,216 - 46,930

These ranges represent higher timeframe (HTF) bottoms for the overall HTF trend. There’s a good chance that we could see a reversal within one of these zones, leading to a potential upward move.

However, if these levels don’t hold, we might see a deeper extension into the 37.7k - 43.5k range, which is an attractive liquidity zone. But this lower range only becomes relevant if the higher ranges fail to hold. That said, both ranges above are strong support levels and could propel the price back to all-time highs (ATH) of 70k - 72k or even higher, potentially reaching 89k - 93k.

Currently, we’ve already hit 53,400, a key level that’s holding off a potential sharp drop. If we lose this level, we could see a rapid decline to 3k. (Current price: 53,127)

Be prepared! We’ve already touched the 52,550 level, which is acting as major support. If it breaks, the ranges mentioned above become the most likely areas for a bounce, although the 52k range could still hold. However, I’m not counting on it, as we’ve previously sliced right through that level.

Additional Market Update:-

• BTC is up 68% in volume.

• ETH is also up 68% in volume.

Both BTC and ETH have seen significant buying activity during this dip, especially since yesterday, with most of it happening today.

On the lower timeframe (LTF), the market is risky as we’re sitting at the final support zone of 52,550. Being the weekend, when mostly private retail traders are active, there’s a risk that they could get dragged down into losses, with many long positions liquidated before we move higher. LTFs are always tricky, and while volume is still low, pumps are easy.

I believe that the 52,550 support won’t hold through the weekend.

We’re likely to see the above-mentioned levels by the end of the weekend or early next week. Once those levels are reached, the market should stabilize, bringing a healthier, less choppy environment.

So it's just about a couple of weeks. Stay strong don't do anything stupid, I'll come up with more information very soon for trade setups on Altcoins.

Stay tuned and make sure you follow me.

HIt the like if you like it and repost so this information reaches more people!

Thank you

#PEACE

FUNDAMENTAL ANALYSIS OF CRYPTOCURRENCIES

FUNDAMENTAL ANALYSIS OF CRYPTOCURRENCIES

As a crypto trader, you must know what causes prices to rise, fall, or idle.

While markets are not always predictable, with sound analysis, you can often get at least a reasonably good idea of what the most probable scenarios may be.

A good trader knows when to trade. They recognize market trends and identify areas where they can reliably predict what is going to happen next.

But how do they do it?

There are two answers here: fundamental analysis and technical analysis.

Technical analysis is a tool, or method, used to predict the probable future price movement of a currency pair based on previous market data.

Fundamental analysis looks at the fundamentals of an asset, or in other words, every aspect of an asset that contributes to its overall value.

In this blog, we will focus on fundamental analysis.

The Basics Of Fundamental Analysis

Fundamental Analysis is not only for cryptocurrencies it’s ingrained in other types of trading too. Fundamental analysis is researching your investments to determine their future value.

If you can recognize the future potential of a project, or realize that the project is presently undervalued in the market, you can buy that coin and earn profit. Keep an eye on their social media platforms if they announced some news then you can easily make money.

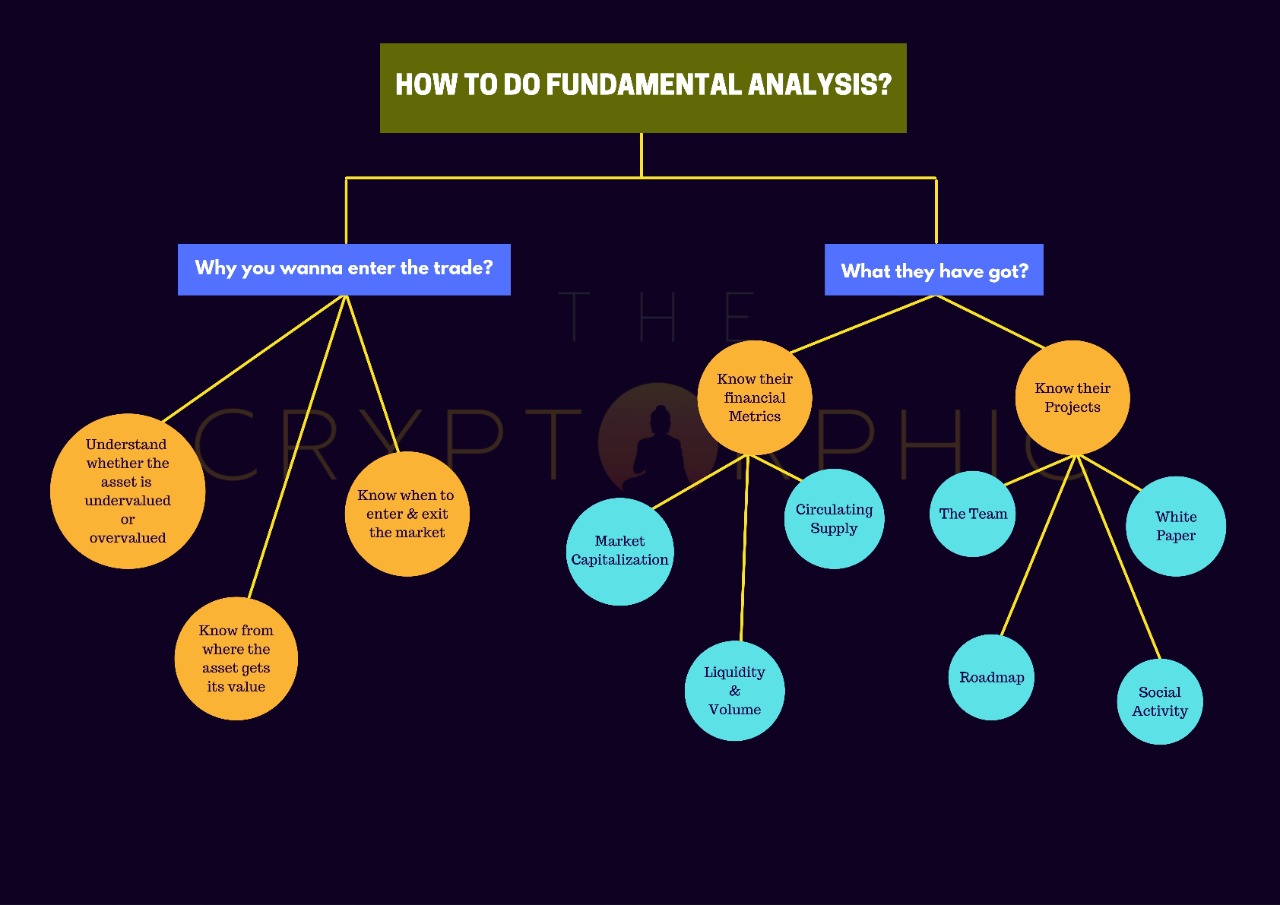

HOW TO DO FUNDAMENTAL ANALYSIS?

There are several factors to look out for when we analyze any coin:

- Team

- Roadmap

- Development and releases

- Whitepaper

- Partnerships

- Community and reviews

- Liquidity and volume

- Real-world use case

- Social Activity

- Price history

- Market cap

Team

Successful products have great teams behind them.

What can you find out about the team?

Look at the senior management: who are they, where they are from, what’s their history? If there is a skilled team with a wealth of experience, that’s definitely a good sign.

Roadmap

Crypto projects often have roadmaps in one form or another. They show what upcoming plans there are to move the project forward. Take a look at these plans and see what you think.

Development and releases

Just like a roadmap looks into the future, you can look back and see how a project has performed over time in terms of development.

If there is a healthy history of releases, that’s a good look.

Whitepaper

Whitepapers outline the essential details of a project. They are technical documents, but they are important. They will detail everything you need to know about how it works, which can massively influence your investment decisions.

Read whitepapers before investing.

Partnerships

In crypto, partnerships are important for assigning value, but make sure you understand the details of the partnership before passing judgment.

Community and reviews

Take a dive into the community and read reviews about the project. See what different people have to say about it.

Liquidity and volume

Liquidity is the ability of a coin to be easily converted into cash or other coins.

Liquidity is important for all tradable assets including cryptocurrencies. Low liquidity levels mean that market volatility is present, causing spikes in cryptocurrency prices. High liquidity, on the other hand, means there is a stable market, with few fluctuations in price.

Real-world use case

This is important. While a project may have great fundamentals, ask yourself whether it has to use blockchain and have its own cryptocurrency. If it doesn’t, that is something to think about. It could sway long-term value, one way or another.

Social Activity

It is the easiest way to earn money in crypto. You just have to keep a close eye on social media platforms like Twitter, Telegram, Reddit, etc. you can easily check any cryptocurrency social activity by just searching the name of that currency on our website.

Price history

Cryptocurrencies come and go. If a project has been established for a long time and has consistently maintained value relative to other cryptos, perhaps it has longevity.

However, larger returns may be found from smaller, relatively unknown coins that breakout and become mainstream.

Market cap

A market cap takes into account the supply of crypto and derives the actual value based on that.

Take into account the market cap to see the potential for growth. Projects with larger market caps most likely have smaller growth potential relative to lower cap ones.

Summary:

Whenever you are looking for an investment keep these things in mind. It is a great way for you to get started analyzing potential coins to help you become a better trader.